Fitch Ratings: Slower Growth in Indonesia's Property Sector

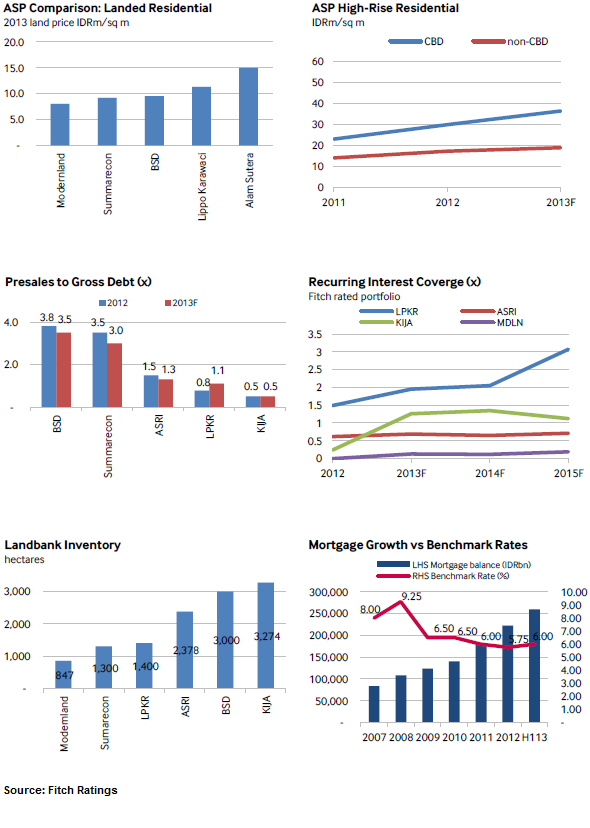

Fitch Ratings, the global rating agency, expects slower growth in Indonesia's property sector for the next 12 months. However, for the longer term, the institution still maintains a positive outlook as Indonesia is characterized by high urbanization, a rapidly expanding middle class and low mortgage rates. Since the revival in 2011, the average selling price of Indonesia's residential properties increased by about 30 percent year-on-year, particularly in the Greater Jakarta area.

Fitch Ratings, the global rating agency, expects slower growth in Indonesia's property sector for the next 12 months. However, for the longer term, the institution still maintains a positive outlook as Indonesia is characterized by high urbanization, a rapidly expanding middle class and low mortgage rates. Since the revival in 2011, the average selling price of Indonesia's residential properties increased by about 30 percent year-on-year, particularly in the Greater Jakarta area.

Notable examples that have posted robust growth are landed residential in Serpong/Tangerang, and high-rise residential properties in Jakarta's central business district, increasing 38 percent and 22 percent respectively, year-to-date. The institution believes Jakarta will continue to be the driver and benchmark for Indonesia's property prices as this mega-city is the center for business, government and education.

In the report, Fitch Ratings mentioned a number of issues to watch:

• Impact from new policy: The central bank’s move to raise its benchmark interest rate (BI rate) by 50 basis points to seven percent in late-August 2013 intensifies pressures on the mortgage market, especially after several new policies were introduced in July 2013, such as minimum down-payments.

• Slower presales in 2014: Fitch expects developers to post slower presales growth because of a temporary weakening in spending power coupled with a high average selling price base.

• Higher acquisition costs: Land acquisition costs increase in line with average selling price growth. Fitch also anticipates stricter government controls over new high-rise developments in Jakarta to further compress the overall margins of developers.

Ratings impact: neutral

"Fitch expects rated property developers to weather a more challenging operating environment in the next 12 months with sufficient liquidity buffers and a well-distributed debt maturity profile. Liquidity is largely supported by the presales model, which allows fast cash-collection cycles, as well as a steady recurring revenue base. Higher-rated property developers generally have a solid recurring interest cover ratio of 1x or above, indicating comfortable coverage to interest expenses. Another mitigating factor in the case of a slowdown is a large landbank reserve - averaging over five years of future development."