29 September 2025 (closed)

Jakarta Composite Index (8,125.20) +85.16 +1.06%

Waspadalah terhadap penipu yang aktif di WA mengatasnamakan Indonesia Investments

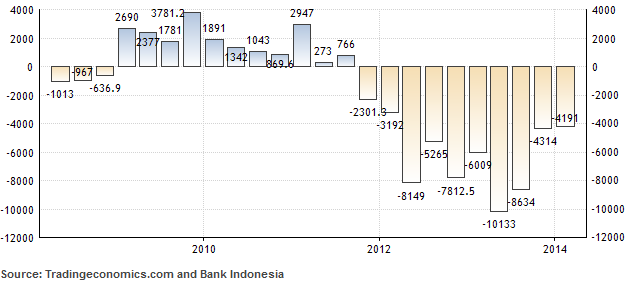

Current Account Deficit of Indonesia Eases to USD $4.2 Billion in Q1-2014

The central bank of Indonesia (Bank Indonesia) announced that the improving trend of the current account deficit continued in the first quarter (January-March) of 2014. The current account deficit fell from USD $4.3 billion, equivalent to 2.12 percent of the country's gross domestic product (GDP) in the fourth quarter of 2013 to USD $4.2 billion (2.06 percent of GDP) in Q1-2014. This improvement was brought about due to a decrease in imports of goods and the narrowing deficits in the services and income accounts.

Current Account of Indonesia (USD Million)

Non-oil & gas imports still contracted following the moderation in domestic demand, evidenced by the decline of imports of raw materials and capital goods. Although non-oil & gas imports have decreased, the non-oil & gas trade surplus in Q1-2014 was lower than in the previous quarter as non-oil & gas export growth in nominal terms slipped back into negative territory due to weakening global demand, particularly in China, the decline in global commodity prices, and the temporary impact of the ban on exports of raw minerals. In addition, oil imports also contracted further following lower fuel consumption at the start of the year. However, oil and gas exports led to the country's increased oil and gas trade deficit. Meanwhile, the more modest deficit in services account was explained by reduced payments on transportation services, in keeping with the drop in imports of goods, and reduced payments on travel services, along with the lower number of the Indonesian traveling abroad in the aftermath of the hajj season and year-end holiday period. In the same period, the income account deficit also narrowed, mainly due to reduced foreign debt interest payments as scheduled.

On the other hand, the improvement in Indonesia’s economic fundamentals bolstered foreign investors’ interest to invest in Indonesia so that the capital and financial account charted an USD $7.8 billion surplus. Total foreign inflows increased from USD $10.5 billion in Q4-2013 to USD $12.3 billion in Q1-2014, primarily in portfolio instruments. The increased inflows of foreign portfolio investments, in addition to the impact of an increase in net foreign buying in rupiah denominated portfolio instruments, was also supported by the government's step to issue foreign currency bonds as a source of fiscal financing. The capital and financial account surplus also sourced from foreign direct investment inflows that were still robust and recorded the same levels compared to the previous quarter. However, the capital and financial account surplus in Q1-2014 was lower than the surplus in Q4-2013 amounting to USD $8.8 billion mainly due to placements of private savings abroad in keeping with strong inflows in portfolio investment.

Improvement in the current account and the capital and financial account surplus caused Indonesia’s overall balance of payments (BOP) in Q1-2014 to record a surplus of USD $2.1 billion. The surplus in Q1-2014 BOP, in turn pushing up international reserves from USD $99.4 billion in Q4-2013 to USD $102.6 billion in Q1-2014, or equivalent to 5.7 months of imports and government foreign debt payments. In April 2014, international reserves continued to increase to USD $105.6 billion. Bank Indonesia views the BOP performance in Q1-2014 to contribute positively to a more balanced economic growth.

Bank Indonesia will implement the sixth edition of the Balance of Payments and International Investment Position Manual (BPM6) issued by the International Monetary Fund (IMF) in Indonesia’s balance of payments statistics starting from Q2-2014 (data published in August 2014). Explanation of the impact of the application of the BPM6 the balance of payments statistics can be accessed here. The next publication of Indonesia's Balance of Payments statistics is scheduled for 15 August 2014.

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini