Waspadalah terhadap penipu yang aktif di WA mengatasnamakan Indonesia Investments

11 May 2025 (closed)

Jakarta Composite Index (6,832.80) +5.05 +0.07%

World Bank: Indonesia Quarterly Report "Slower Growth; High Risks"

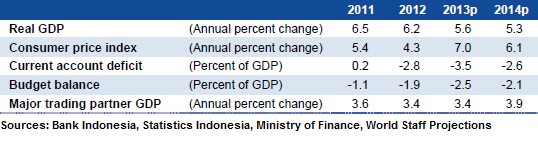

The World Bank released the December edition of its Indonesia economic quarterly report. The title of the report “Slower Growth; High Risks” leaves little to the imagination. The World Bank expects Indonesia’s economic growth to slow to 5.3 percent in 2014 amid external shocks, most notably the Federal Reserve 'tapering'. The report states that “while policymakers in Indonesia have taken steps to encourage near-term macroeconomic stability, further structural reforms are needed to support export performance and encourage long-term faster growth.”

The year 2013 was colored by significant policy changes as capital outflows emerged amid global uncertainty. The Indonesia rupiah exchange rate fell 25 percent against the US dollar, while Indonesia’s benchmark stock index (IHSG) experienced a sharp correction. Moreover, inflation accelerated to nearly nine percent (year-on-year) after the government raised prices of subsidized fuels in June 2013. This made Indonesia’s central bank (Bank Indonesia) decide to gradually raise the benchmark interest rate (BI rate) from 5.75 percent in June 2013 to 7.50 percent in November 2013. As a consequence, high inflation and the country's high interest rate environment led to slowing domestic consumption and because the latter accounts for about 55 percent of the country’s gross domestic product growth, it has resulted in slowing growth. Moreover, amid weak global demand for commodities (causing plunging commodity prices), Indonesia’s exports have not picked up yet.

The World Bank notes that “the monetary policy and exchange rate adjustments seen in 2013 are broadly positive for macroeconomic stability, however, they also carry costs and bring with them risks. Therefore, moving into 2014 the recent, necessary focus on near-term macroeconomic stability should continue to be augmented with more steps to support a virtuous cycle of strong investment, including foreign investment, and output growth.”

World Bank Projections:

The Bank also advises that Indonesia should take advantage of the weak rupiah exchange rate by maximizing exports through increasing the country’s competitiveness.

Download the full Indonesia economic quarterly report “Slower Growth; High Risks”

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini