Does the American Banking Crisis Allow Some Marked Rupiah Appreciation in the Near Future?

There are analysts who believe that the international banking crisis that started in the second week of March 2023 is just the beginning of more to come. After Credit Suisse was affected amid the global decline of confidence in the banking sector, some now fear that German bank Deutsche Bank could be the next victim. What does this mean for the Indonesian rupiah?

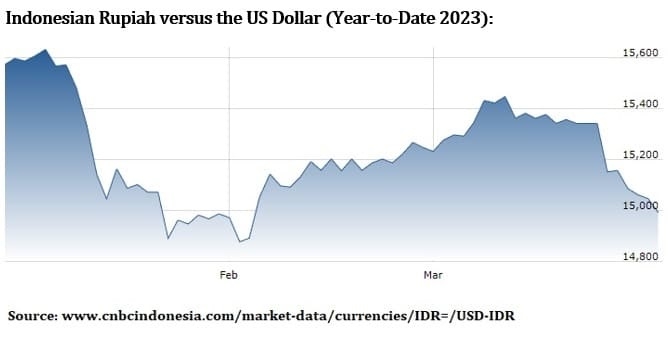

It is interesting to take a look at the chart below. It shows that the rupiah started to appreciate against the US dollar when the global banking crisis kicked in.

On 10 March 2023 (which is around the time when the crisis started) the rupiah was at a level of IDR 15,445 per US dollar. After 23 March 2023 we in fact see very strong rupiah appreciation against the greenback, ending the month of March 2023 at the level of IDR 14,990 per US dollar (implying the Indonesian rupiah strengthened by a total of 1.7 percent against the US dollar in March 2023).

Typically, when there is global turmoil, we see rapid and massive capital outflows from (higher-yielding-yet-riskier) emerging markets like Indonesia toward the safe havens. And, indeed, we did notice this in the stock market as the Jakarta Composite Index plunged by more than 3 percent between 13 and 16 March 2023. Afterwards, however, we saw a steep rebound as risk appetite returned.

The reason behind the return of risk appetite is that markets expect the US Federal Reserve to pause its aggressive interest rate hikes, while at the same time injecting more liquidity into the US banking system through the Federal Reserve’s emergency loan support (or Bank Term Funding Program), which might be as high as USD $2.0 trillion of funds. This new facility aims to make sure that financial institutions can meet the needs of their depositors (thereby easing global concerns considerably).

[...]

This is the introduction of the article. The full article is available in our March 2023 report. This report (an electronic report) can be ordered by sending an email to info@indonesia-investments.com or a message to +62.882.9875.1125 (including WhatsApp).

Take a glance inside the report here!

Price of this report:

Rp 150,000

USD $10,-

EUR €10,-

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini