Bauxite Ore Export Ban; Developing a Domestic Mineral Refining & Processing Industry in Indonesia

On 10 June 2023 the Indonesian government imposed a ban on bauxite ore exports in a bid to encourage the development of a domestic bauxite processing and refining industry. This move was not a surprise. Over the past couple of years, government officials had mentioned their desire to ban bauxite ore exports from June 2023. And in December 2022 it was Indonesian President Joko Widodo himself who reaffirmed this ambition.

Moreover, this bauxite ore export ban forms part of a wider national program of the Indonesian government; a program through which the country is eager to develop its own downstream metal industries, hence boosting revenue from this sector. Back in January 2020 nickel had become subjected to a similar export ban, and certainly not without success as the value of Indonesia’s nickel exports increased rapidly after 2020. Based on President Widodo’s words, exports of nickel ore only reached a value of around IDR 17 trillion (approx. USD $1.17 billion) ahead of the nickel ore ban, but the value of the country’s processed nickel exports soared to around IDR 450 trillion (approx. USD $31 billion) in 2022. That is a serious improvement.

This impressive increase can be attributed to rapidly rising demand for nickel from the global electric automotive industry (with Indonesia’s nickel exports particularly going to China and Japan), and to the growing number of nickel smelters that come on stream in Indonesia. And, that is exactly what the mineral ore export ban aims to do: it encourages (foreign and domestic) investment in onshore smelting facilities.

However, Indonesia’s nickel ore export ban also caused some friction. The European Union (EU) filed a complaint at the World Trade Organization (WTO) in November 2019 as the bloc is negatively affected by Indonesia’s nickel ore export ban. After the WTO ruled (in November 2022) that this ban constitutes a violation of WTO rules, Indonesia decided to appeal this decision in December 2022. It might take until 2024 or 2025 before this appeal is handled by the WTO.

However, whatever the outcome of the WTO, it seems quite clear that Indonesia will not let its mineral refining and processing ambitions be derailed. President Widodo has in fact repeatedly hinted in statements that Indonesia should essentially ignore international resistance to the refining and processing development program in the country’s mining sector. And the success of developing downstream segments in the value chain in nickel mining certainly encourages Indonesia to target other minerals.

What Is Bauxite?

Bauxite, a sedimentary rock, is the world's main raw material for alumina. Alumina is then turned into aluminium through a smelting process. Bauxite is also a source of gallium (a material that is commonly used in thermometers, semiconductors for electronics, and light-emitting diodes).

It is estimated that more than 90 percent of global bauxite production is consumed in the aluminium industry. Aluminium, a silvery-white, lightweight metal that is soft and malleable, is used in a big variety of products including trains, cars, construction, cans, foils, kitchen utensils, window frames, beer kegs, and aeroplane parts.

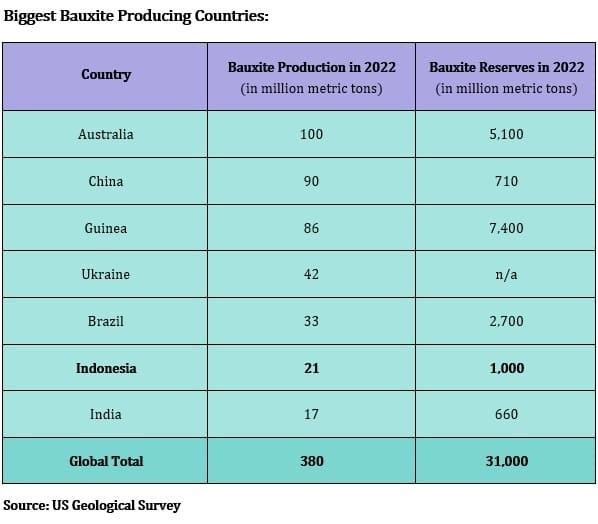

Bauxite is found in most countries. However, the larger deposits are found in tropical countries. Major deposits of gravels mixed with sand were discovered in Australia back in the 1950s. Australia then became the world's top producer of bauxite by the early 21st century. Indonesia ranks among the biggest bauxite producers. However, its impact on the global market is not too big. Based on data from the US Geological Survey, global bauxite production totaled around 380 million metric tons in 2022, while Indonesia produced 21 million metric tons of bauxite that year. So, this implies that Indonesia’s share of global production stands at 5.5 percent only. This is in stark contrast to its role in nickel mining (as Indonesia is the world’s largest producer of nickel, contributing around 30-35 percent to total global output and holding around 22 percent of global reserves).

[..]

This is the introduction of the article. The full article is available in our June 2023 report. This report (an electronic report) can be ordered by sending an email to info@indonesia-investments.com or a message to +62.882.9875.1125 (including WhatsApp).

Take a glance inside the report here!

Price of this report:

Rp 150,000

USD $10,-

EUR €10,-

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini