September 2020 Report Indonesia Investments; Infrastructure in Focus

Across the world, concern over the COVID-19 pandemic grew in September 2020 as the number of new COVID-19 cases continued to rise rapidly. Worldwide, at the end of September 2020, some 34 million people have been infected with the virus, while more than one million people have died after contracting the virus.

In fact, in several European nations – such as the Netherlands, France, Spain, and the United Kingdom – the much-feared second wave seems to have arrived, prompting governments to impose new measures or scale up existing ones. These decisions will certainly have devastating consequences for national economies.

In Indonesia there is no need to be concerned about a second wave because the first wave is not over yet. In line with expanding testing capacity, the number of new daily confirmed COVID-19 cases has been growing ever since the pandemic first arrived in Indonesia in early March 2020.

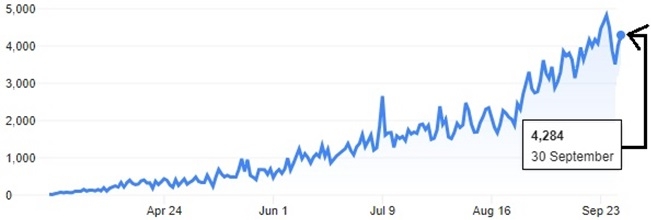

New Confirmed COVID-19 Cases in Indonesia (Per Day):

Especially in the second half of September 2020 the number of new COVID-19 cases in Indonesia accelerated sharply and seemed heading for 5,000 new COVID-19 cases per day by the end of September 2020. However, in the last five days of September 2020 there was a sudden drop in new COVID-19 cases. Unfortunately, on the last day of the month another rebound occurred (see the graph on the previous page), hence it is too soon to come up with optimistic conclusions. In fact, if we look at the chart, then we can see that a low is often followed by a new peak. As such, Indonesia still had to cope with an accelerating trend in new COVID-19 cases in September 2020.

The sudden decline in new COVID-19 cases on 26, 27 and 28 September 2020 could be related to the stricter social and business restrictions (in Indonesian: Pembatasan Sosial Berskala Besar, or PSBB) that were imposed in the capital city of Jakarta as well as in several urban centers of densely populated West Java and Banten.

Indeed, data from Jakarta show slowing growth in new COVID-19 cases in the second half of September 2020. This coincides with the stricter PSBB that was imposed in Jakarta. Jakarta Governor Anies Baswedan imposed a stricter PSBB on 14 September 2020, thereby taking it up a notch from the ‘transition PSBB’ (PSBB Transisi) that was in place earlier (the transition PSBB meant that social and business restrictions were gradually being eased in an effort to support the local economy).[1]

Baswedan’s decision immediately caused the Jakarta Composite Index (Indonesia’s benchmark stock index) to dive into deep red territory as investors are particularly concerned that harsher lockdowns (especially in a key economic center like Jakarta) will curtail room for the nation’s economic recovery. After all, in the second quarter (when harsh lockdowns had been put in place) the Indonesian economy contracted by 5.32 percent (y/y). So, in case strict lockdowns return (for a prolonged period of time), it certainly disrupts economic activity in a significant manner in Q3 and Q4.

The key differences between Jakarta’s new stricter PSBB and the PSBB Transisi are that places of worship now need to close, people are encouraged to work from home (instead of the office), and people cannot eat or drink inside restaurants and cafes (but they can take food and drinks back home). In the second week of October 2020 it should become clearer whether the stricter PSBBs indeed help to soften the spread of the COVID-19 virus in Indonesia.

Moreover, near the end of September the Jakarta Administration decided to extend the stricter PSBB up to 11 October 2020. And others followed Jakarta’s example. For example, West Java Governor Ridwan Kamil extended the PSBBs in Bogor, Depok, and Bekasi to 27 October 2020, while key districts in the Banten Province extended their PSBBs to 20 October 2020. These are all key economic centers for the country.

Extending these (semi) lockdowns is certainly not without risks. While they help to limit the spread of the COVID-19 virus, they do also kill many businesses, thereby triggering a sharp increase in unemployment as well as in poverty. A recent survey conducted by Indonesia’s Statistical Agency (Badan Pusat Statistik, BPS) shows that 82.9 percent of entrepreneurs reported a significant drop in sales during the COVID-19 crisis (while 14.6 percent indicated that their sales have remained stable, and 2.6 percent actually experienced an increase in sales).

Those who experience a drop in sales amid the COVID-19 crisis involve all types of businesses, ranging from micro, small, medium-sized to big companies. The survey, which was conducted between 1 and 26 July 2020, involved 34,559 respondents, consisting of 6,821 medium and big companies, 2,482 agricultural businesses, and 25,256 micro and small entrepreneurs.

Based on the BPS survey, businesses that are hit hardest are those in the industries of accommodations, food and drinks, transportation, warehousing, construction and processing. They are the biggest victims of tumbling demand and troubled logistics chains caused by the self-imposed restrictions. And quite alarming is that 19 percent of respondents claim that their business cannot survive for another three months if circumstances do not change, and if no support is given by authorities (for example in the form of fiscal incentives or a discount in electricity prices).

The problem is, however, that these temporary lockdowns would only be useful if a vaccine becomes available soon. In that case a large portion of the people could get the vaccine before the lockdown is lifted. But the reality is that a (safe and effective) vaccine will not be available anytime soon. It may need until the second half of 2021 to see a COVID-19 vaccine on the market.

Imposing lockdowns until late-2021 would help to slow the spread of COVID-19 but it would certainly do some serious harm to economies (which can have far-reaching consequences for people as millions are bound to lose their jobs, and may even fall into full-blown poverty; not to mention those who postpone checkups at the hospital and therefore have the cancer diagnosis come too late). This may mean that the cure is in fact worse than the disease. For policymakers it poses a very tough dilemma: prolong the lives of tens of thousands of vulnerable people such as elderly and those with underlying diseases, or have millions of people lose their incomes or business.

Moreover, there is the real threat that growth in the number of new COVID-19 cases will accelerate in the coming months. Not only would this be the outcome of further expanding testing capacity, but Indonesia is also approaching the rainy season.

Typically, Indonesia’s rainy season starts in October. And when it rains, people tend to be indoors, making it easier for a virus to be spread. That also explains why more Indonesians have influenza (flu) during the rainy season than during the dry season. Considering (based on the opinions of virologists in the media) the COVID-19 virus behaves similar to the flu, we can expect to see further rising numbers of COVID-19 cases in Indonesia in the rainy season (unless there are very strict lockdowns).

Focus on Infrastructure Development in Indonesia

Over the past six months we have focused heavily on the COVID-19 pandemic in our monthly reports. This was certainly justified as the crisis has a huge impact on the country’s macroeconomic indicators, business sectors, and the national economy as a whole. However, starting from this edition we want to return our focus to other subjects that are at the heart of the Indonesian economy (although obviously we will continue to monitor – and report about – the COVID-19 crisis in Indonesia in future reports, albeit not as extensively as before, barring any unforeseen developments).

In this month’s edition our focus goes to infrastructure development. Among the structural problems of Indonesia is the lack of infrastructure development, both in terms of quality and quantity (and in terms of hard and soft infrastructure). This is undermining the competitiveness of Indonesia’s businesses (compared to foreign counterparts who can enjoy optimized infrastructure at home, and thus enjoy lower logistics costs) and undermines the flow of foreign direct investment into Indonesia. Moreover, lack of infrastructure development also creates other issues, for example when children cannot reach a school, or, when people who need medical treatment cannot visit a health clinic or hospital because road access to the facility is restricted. Considering only healthy people can contribute to the expansion and development of the economy (by doing productive work) while it are mostly educated people who come up with innovative and efficient business solutions or inventions, the lack of infrastructure development is not only undermining the development of Indonesia’s human capital but also undermining the national economy.

President Joko Widodo stands out as “Indonesia’s Infrastructure President”. He has indeed imposed a number of structural reforms that allowed a renewed focus of the government on infrastructure development across the vast Archipelago. However, it is no easy undertaking in a decentralized country where red tape is rife (making it much harder to attract private sector participation in capital-intensive projects). And there are certainly no quick fixes as big infrastructure projects require many years of development.

In this month’s edition we devote much attention to infrastructure development in Indonesia. We offer a general overview and (in separate chapters) discuss several infrastructure-related industries (focus on connectivity such as the country’s airport industry and aviation) and construction projects (such as the Patimban Seaport).

Indonesia Investments

Jakarta (Indonesia)

1 October 2020

[1] However, we should not conclude too soon that the PSBB is behind the drop in new COVID-19 cases between 26-29 September 2020 because data from https://corona.jakarta.go.id/id/data-pemantauan show that the number of COVID-19 tests in Jakarta fell drastically in that period. As such, fewer tests could also explain why fewer new COVID-19 cases were found in Jakarta.

Order the report by sending an email to info@indonesia-investments.com or message to +62(0)8.788.410.6944 (incl. WhatsApp).

Take a look inside the report!

Price:

- IDR 150,000

- USD $10.00

- EUR €10.00

View a list of all our monthly reports here.

Take a Glance Inside the September 2020 Report:

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini