Stock Market & Rupiah Update Indonesia - 31 January 2018

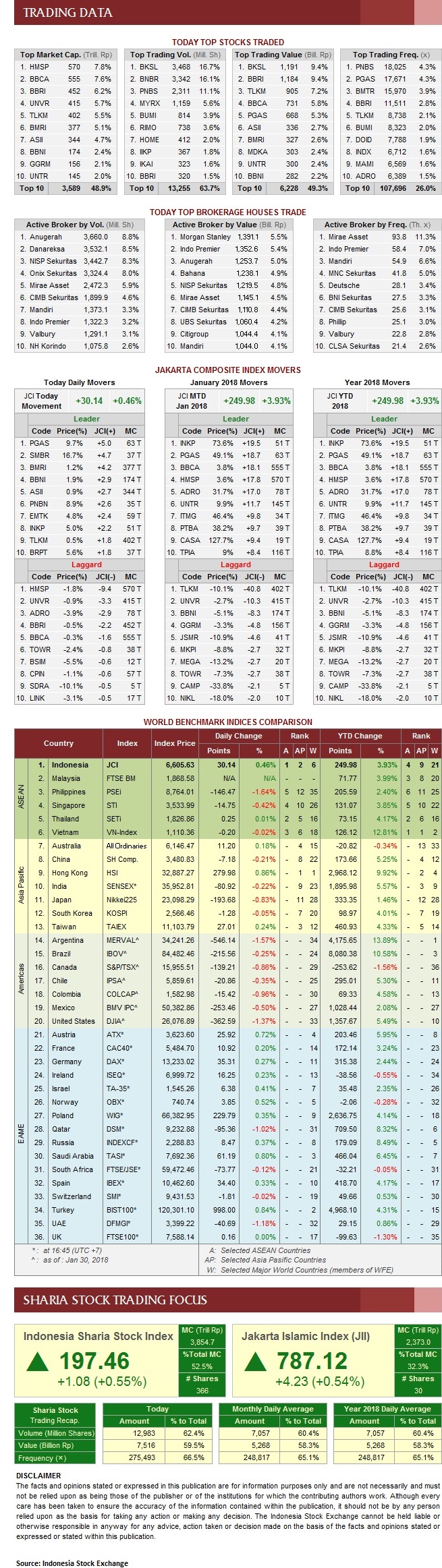

The benchmark Jakarta Composite Index of Indonesia - Jakarta Composite Index - rebounded 0.46 percent to 6,605.63 points on Wednesday (31/01) after the heavy 1.57 percent drop on the preceding day when Asian stock markets were dragged down by Wall Street and rising global bond yields.

Rising bond yields have a negative effect on stocks as they turn bonds into a more attractive investment option while higher bond yields also raise borrowing costs for companies.

Investors, seemingly, did not react much to US President Donald Trump's State of the Union speech (despite some tough rhetoric on immigration and North Korea) but are mainly focusing on the results of the Federal Reserve's two-day policy meeting that started yesterday. The Fed is not expected to alter its monetary policy, including interest rates, but market participants are eager to learn some hints on the institution's outlook for rates in the remainder of the year (a possible tightening in March?).

As a result, Asian-Pacific stock markets were mixed on Wednesday (31/01). Heavy losses occurred in the Philippines and Japan, while good gains were recorded in Hong Kong and New Zealand.

The US dollar weakened against most currencies as the Fed is expected to remain patient. The Indonesian rupiah strengthened 0.35 percent to IDR 13,386 per US dollar on Wednesday (31/01), based on the Bloomberg Dollar Index.

Bank Indonesia's benchmark rupiah rate (Jakarta Interbank Spot Dollar Rate, abbreviated JISDOR), however, depreciated 0.11 percent to IDR 13,413 per US dollar on Wednesday (31/01).

Indonesian Rupiah versus US Dollar (JISDOR):

| Source: Bank IndonesiaConsidering Wall Street opened strong on Wednesday (31/01) - due to good corporate earnings (especially Boeing) and positive jobs data released by payroll processor ADP (ahead of the US government's official jobs data due on Friday) - Asian stocks may be lifted on Thursday (01/02). However, it is important to await the conclusion of the Fed meeting later today.

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini