Indonesia's Central Bank Pursuing Economic Growth, Cuts Interest Rate Again

The central bank of Indonesia (Bank Indonesia) surprised markets by cutting its benchmark interest rate by 25 basis points to 4.75 percent at the September 2025 monetary policy meeting. It was the sixth rate cut in a monetary easing cycle that started in September 2024.

After the two-day meeting on 16-17 September 2025, Bank Indonesia officials agreed to cut the BI Rate from 5.00 percent to 4.75 percent in an effort to stimulate national economic growth. The central bank also lowered its deposit facility and lending facility rates by 0.25 percent to 3.75 percent and 5.50 percent, respectively.

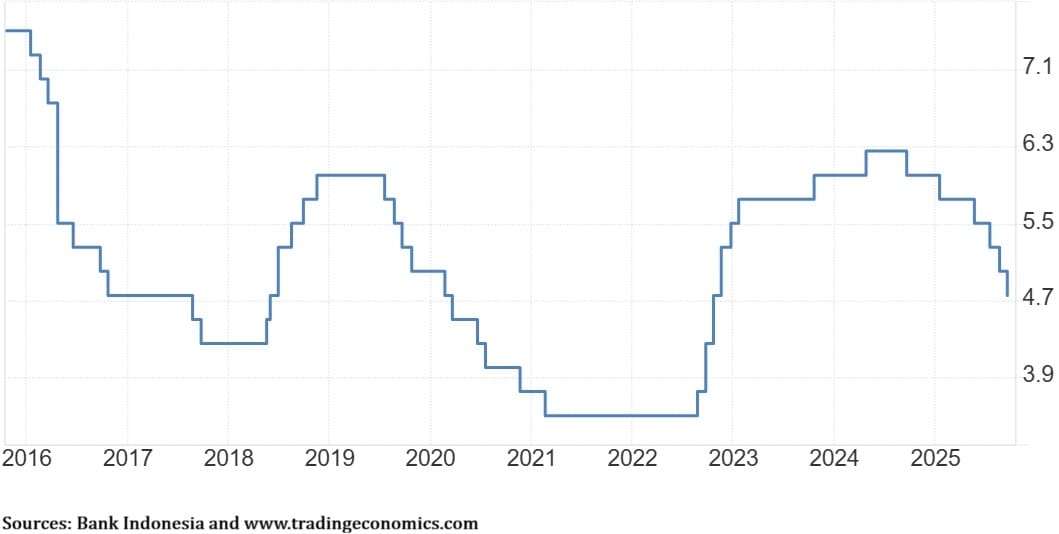

Chart A shows the current easing cycle in Indonesia. In August 2024 the BI Rate was still at 6.25 percent, a level needed to prevent excessive capital outflows from Indonesia (caused by the US Federal Reserve raising its own key rate to combat high US inflation). However, the BI Rate now has been cut - gradually, yet somewhat aggressively - to 4.75 percent.

Chart A; Bank Indonesia's Benchmark Interest Rate 2015-2025:

While we are surprised at Bank Indonesia's rate cut, it is true that there has been quite some political and social unrest across Indonesia over the past month that has made the government push for more stimulus in an effort to boost economic growth, including an IDR 200 trillion liquidity injection into Indonesia's state-owned banks to encourage lending. Possibly, Bank Indonesia feels this pressure too. By pushing down borrowing costs, there should emerge higher demand for credit, and thus accelerating economic activity across Southeast Asia's largest economy.

The reason why we did not expect to see an interest rate cut in September 2025 was because the rupiah exchange rate has been weakening further. A weakening rupiah has both positive and negative effects on Indonesia's economy. While it can be beneficial for certain sectors, the negative impacts, particularly on inflation and debt, are often more dominant and concerning for the overall economic stability. Among the key tasks of Bank Indonesia is to maintain a stable rupiah rate.

Credit growth has been subdued in Indonesia (where double-digit credit growth rates were common). In August 2025 credit growth in the banking industry stood at 7.56 percent year-on-year (y/y), up from 7.03 percent (y/y) one month earlier. Bank Indonesia Governor Perry Warjiyo urges the country's banks to cut their interest rates.

Federal Reserve

While Bank Indonesia seems to be under a bit of political pressure to cut its benchmark interest rate, the US Federal Reserve might be particularly cautious to avoid the perception that it is being influenced by politics. US President Donald Trump has repeatedly urged the Federal Reserve to cut rates aggressively in order to boost the US economy. And so, while the Federal Reserve indeed went for a widely anticipated interest rate cut on Wednesday (17 September 2025), it cut its key rate by 0.25 percentage point only (to the range of 4.00 - 4.25 percent).

In a statement, the Federal Reserve noted that uncertainty about the economic outlook remains elevated with lower job growth and higher inflation being in conflict with the Federal Reserve’s twin goals of stable prices and full employment.

The Federal Reserve also signalled that two more rate cuts are on the horizon before the end of 2025. For Bank Indonesia it is certainly positive to see the Federal Reserve cutting its interest rates as this reduces external pressures. When the Federal Reserve raises rates, it strengthens the US dollar and makes US dollar-denominated assets more attractive to global investors, which can lead to capital flowing out of Indonesia and putting downward pressure on the rupiah (as well as Indonesian stocks and bonds). A Federal Reserve rate cut reverses this trend. It makes US dollar assets less attractive, which can lead to capital flowing back into emerging markets such as Indonesia. This influx of capital strengthens the rupiah, helping to stabilize its exchange rate without Bank Indonesia having to intervene as much.

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini