Economic Update: Indonesia's Economy Defies Expectations, Grows 5.12% in Q2-2025

Indonesia's economic growth in the second quarter of 2025 (Q2-2025) significantly exceeded our projection. While our projection was set in the range of 4.7-4.9 percent year-on-year (y/y), Indonesia’s Statistical Agency (BPS) reported on 5 August 2025 that the official growth rate was 5.12 percent (y/y) in Q2-2025.

The official figure is particularly surprising because most macroeconomic indicators had pointed to a slowdown, not an acceleration of gross domestic product (or GDP) growth. Media reports confirm that this outcome caught many analysts off guard.

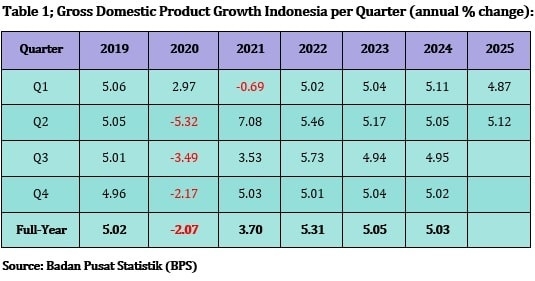

Table 1 shows that the 5.12 percent (y/y) growth rate in Q2-2025 was Indonesia's best growth rate in two years. This is a crucial development, as maintaining growth above the 5.0 percent threshold is widely considered necessary to generate enough jobs for the country’s expanding workforce. This, in turn, boosts household wages, increases consumer spending, and attracts direct investment.

This strong outcome brings the Indonesian government's full-year 2025 economic growth target of 5.2 percent (y/y) back within reach. While achieving this target would require a significant acceleration of growth in the second half of the year, the Q2-2025 GDP figure demonstrates that it is now a possibility.

External Environment

Overall, the global situation remained plagued with uncertainties in Q2-2025, with the continuation of wars in Ukraine and Gaza. Simultaneously, US President Donald Trump was disrupting global trade conditions with the threat of new import tariffs. A 10 percent baseline tariff was imposed by the Trump administration at the start of April 2025, with specific reciprocal US import tariffs scheduled to take effect on 1 August 2025 (which falls in Q3-2025). These global headwinds created a challenging backdrop for the Indonesian economy throughout the second quarter.

This chaotic policy-making from the Trump administration is one of the reasons the US Federal Reserve has been pressured to keep its benchmark interest rate higher for a longer period. Consequently, these high US interest rates make it difficult for other central banks, including Bank Indonesia, to cut their own key rates. After all, if emerging markets don’t offer attractive yields, global investors will simply favor the safety of US assets. However, these higher-than-necessary benchmark interest rates do somewhat curtail economic activity due to high borrowing costs. It is interesting, though, that Bank Indonesia has been able to gradually cut its benchmark rate since September 2024, although this is believed to be one of the reasons behind the heavy pressures on the Indonesian rupiah (against the US dollar). This extraordinary 5.12 percent (y/y) growth rate, however, suggests that external factors – including the global economic slowdown in Q2-2025 – didn’t manage to drag down the Indonesian economy.

How Reliable Are the BPS Data?

The wide discrepancy between analysts' projections – based on a variety of weak Q2-2025 economic data – and the remarkably strong official Q2-2025 GDP figure has inevitably raised questions about the reliability of BPS data. Could it be that the BPS data were unintentionally (or even intentionally) distorted?

We must discuss this topic because it has become a central point of conversation among analysts, economists, and journalists. Initially, these discussions were held behind the curtains, but later, criticism was openly expressed. For example, Kompas reported on an open letter from Paramadina University senior economist Wijayanto Samirin, who argued that the Q2-2025 economic growth figure was not in line with the economic reality felt by the public and the business world. He asserted that BPS needs to explain in more detail how this figure was calculated.

Firstly, it is important to note that much of the data collected by BPS is based on statistical estimations rather than comprehensive, factual numbers. For example, to estimate household consumption, BPS relies on surveys to understand consumer habits and spending patterns. BPS then uses statistical modeling to extrapolate from this survey data to represent the entire population. Consequently, the final outcomes can be influenced by the 'honesty' and 'perception' of respondents, as well as by the composition of the selected sample. While there is no reason to assume that these components were significantly different in Q2-2025 compared to earlier quarters, the methodology's reliance on estimation means the data is, in theory, susceptible to manipulation.

[...]

These are the first pages of the article (which consists of 44 pages). To buy the full article (PDF in English) you can contact us through email and/or WhatsApp:

- info@indonesia-investments.com

- +62(0)882.9875.1125

Price of this report:

Rp 50,000 (or equivalent in other currencies)