Bank Indonesia Expected to Keep Key Interest Rate (BI Rate) at 7.50%

The central bank of Indonesia (Bank Indonesia, BI) is expected to keep its benchmark interest rate (BI rate) at 7.50 percent at Thursday’s Board of Governors’ Meeting (14/08) as inflation has eased to 4.53 percent (year on year) in July while the country’s current account deficit may nearly double in the second quarter of 2014 to four percent of gross domestic product (GDP) from 2.06 percent of GDP in the previous quarter. Most analysts expect that Bank Indonesia will maintain the current BI rate for the remainder of 2014.

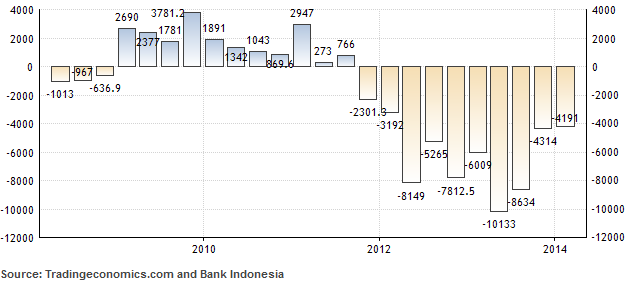

The troubled current account balance of Indonesia is possibly the biggest concern of Bank Indonesia. A current account deficit basically indicates that Indonesia consumes more than it produces. Capital inflows finance the resulting deficit. However, in times of uncertainty (for example uncertainty brought about by the end of US quantitative easing) it is risky to be dependent on volatile capital flows. This year, the country’s current account deficit is expected to reach around 3 percent of GDP, slightly improving from 3.3 percent of GDP in 2013.

The main factors that cause the current account deficit are expensive oil imports, low commodity prices, and the recently-introduced ban on mineral-ore exports. On Friday (15/08), Bank Indonesia is expected to release data regarding the Q2-2014 current account balance.

Indonesia Current Account Balance (in USD million)

Another reason why Indonesia’s central bank is not expected to lower the BI rate in 2014 is because of looming interest rate hikes in the United States in 2015. The US quantitative easing program has been scaled back since the start of the year and it won’t take long before US interest rates will rise. Higher US interest rates will lead to capital outflows from emerging economies, including Indonesia. A relatively high BI rate may be able to limit such capital outflows. Moreover, US interest rate hikes may be followed by higher interest rates in Great Britain and Europe in the two years ahead.

Between June and November 2013, Bank Indonesia gradually raised its BI rate from 5.75 percent to 7.50 percent in an effort to combat inflation, curb the wide current account deficit, limit capital outflows amid the looming end of US quantitative easing, and support the rupiah exchange rate (which depreciated more than 25 percent against the US dollar in 2013). The tighter monetary policy has, however, contributed to slowing economic growth in Indonesia. In the second quarter of 2014, Indonesian GDP growth slowed to 5.12 percent (year-on-year), from a revised 5.22 percent in the previous quarter.

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini