Investing in Indonesia: a basic Introduction to the Indonesia Stock Exchange

This column is the first in a series of columns about investing in Indonesia, in particular about investing in its capital markets. These columns are written by David Sutyanto, research analyst at First Asia Capital, and - as this column is the starting point - he will provide a short and broad outline of the Indonesian capital markets for now. Later, his columns will contain topics that delve more deeply into the capital markets, such as listed companies, and much more.

The capital markets of Indonesia are managed by the Indonesia Stock Exchange (IDX). This IDX is monitored by the Indonesian government through a special institution called the Financial Services Authority of Indonesia (in Indonesian: Otoritas Jasa Keuangan, abbreviated OJK). On an average day, transactions worth of between IDR 5 to 6 trillion (US $520 million to US $620 million) are conducted on the IDX, and it has an average daily volume of about six billion shares. But what about the performance of the index of all listed stocks on the IDX (this index is known as Indeks Harga Saham Gabungan or IHSG)? The answer is 'its performance has been incredible'. Last year, the IHSG - which currently contains 468 daily traded stocks - grew 13 percent. The IHSG is also divided in supporting indices that are formulated based on specific criteria, including sectoral division or other criteria. The LQ45 index, for example, is based on the 45 most actively traded stocks on the IDX.

Indonesia is the fourth most populated country in the world, and its economy shows robust growth at a pace of about six percent per year. Currently, the IHSG is reaching record-high levels almost on a daily basis.

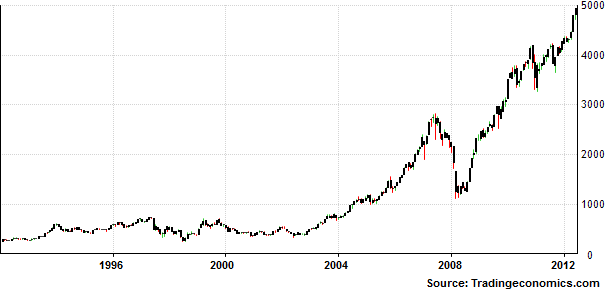

The current trend of the IHSG can be labeled "permabull", which - if we take a look at the stocks movements - is most likely to continue in the years ahead. Why can I claim that? Because in the last 20 years, the IHSG has grown from a mere 250 points in 1992 to 4940 points presently. And if we take into account Indonesia's growing economy, its unemployment rate that is only about 6.3 percent, and its potential for further economic growth, the IHSG should advance to the level of 5500 towards the future.

Furthermore, foreign investors keep purchasing assets in the Indonesian capital markets, which shows the attractiveness of these markets. In 2012, net foreign purchases totaled IDR 19.55 trillion (about US $2 billion). In the period of January to March in 2013, net foreign purchases already stood at IDR 18.5 trillion.

Finally, I would like to conclude that Indonesia's capital markets are highly interesting. They have shown robust growth, supported by the government and by an expanding economy. It is a catalyst that encourages foreign investors to continue buying assets in Indonesia. The current record-high level of the index should not be seen as an obstacle as the valuation of the index is expected to continue its growth.

First Asia Capital Research:

| Index | 1992 | 2013 | Growth |

| IHSG |

250 | 4940 | 18.74 x |

| DJI |

3200 | 14526 | 3.54 x |

| GDAXI |

1599 | 7961 | 3.98 x |

| FTSE |

2482 | 6387 | 1.57 x |

| NIKKEI | 22715 | 12220 | -0.46 x |

Performance of the Indonesia Stock Exchange (1992-2013):