Bank Indonesia Amends LTV/FTV Ratio to Safeguard Financial Stability

Bank Indonesia amended its regulation concerning the Loan To Value (LTV) and Financing To Value (FTV) ratio for property credit and property-backed consumer loans. The LTV/FTV ratio is the ratio between the value of credit/financing that can be allocated by a bank and the corresponding value of collateral in the form of property when the loan is allocated. Property is real property that includes houses, vertical housing (apartments, flats, condominiums and penthouses), home offices and home stores.

Bank Indonesia amended its regulation concerning the Loan To Value (LTV) and Financing To Value (FTV) ratio for property credit and property-backed consumer loans. The LTV/FTV ratio is the ratio between the value of credit/financing that can be allocated by a bank and the corresponding value of collateral in the form of property when the loan is allocated. Property is real property that includes houses, vertical housing (apartments, flats, condominiums and penthouses), home offices and home stores.

At its core, the policy aims to maintain financial system stability and bolster banking resilience by prioritizing prudential principles. This is achieved by, among others, slowing the concentration of credit risk in the property sector as well as promoting the application of prudential principles when disbursing credit. On the other hand, the LTV/FTV regulation also aims to provide low and middle-income earners a greater opportunity to acquire appropriate housing as well as simultaneously enhance aspects of consumer protection in the property sector. Central and regional government housing schemes are exempt from the aforementioned regulation.

The LTV/FTV regulation was amended due to excessive credit growth in the property sector, particularly for houses and high-rises (flats and apartments) subsequent to the introduction of the LTV/FTV regulation in the middle of 2012. Excessive growth in the property sector has also affected borrower behavior in terms of utilizing bank loans/financing. This is evidenced by a number of indicators that show the use of other consumer loans when purchasing property or as an additional down payment on property. In order to anticipate a greater concentration of credit risk in the property sector, while paying due regard to the borrower’s respective risk profile, including repayment capacity, The new regulation will apply a regressive LTV/FTV ratio. The primary objective of the regulation is to anticipate potential default risk attributable to weaker repayment capacity.

The LTV/FTV regulation is accompanied by the application of prudential principles in the allocation of credit through additional requirements in the credit approval process as well as equal treatment for conventional and Islamic banks. The additional requirements include requiring borrowers/potential borrowers to report all outstanding consumer loans related to the purchase of property or property-backed loans from the same bank or indeed from another bank when seeking approval for a loan, which will be taken into consideration when determining the credit facilities available and the appropriate magnitude of LTV/FTV.

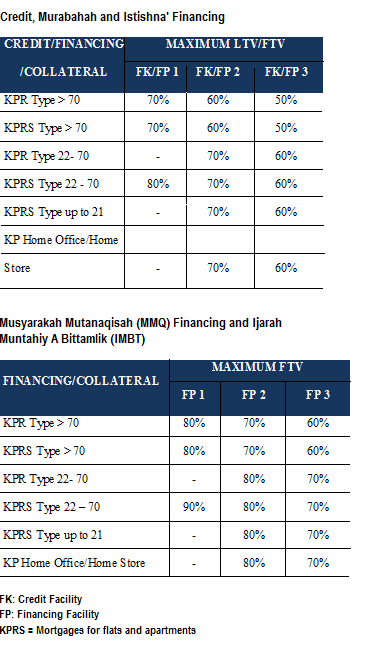

In brief, the new LTV/FTV regulation can be expressed as follows:

The new LTV/FTV regulation controls: (1) the treatment of married borrowers; (2) the handling of top-up credit facilities and new financing based on the property used as collateral from the previous loan; and (3) restrictions on banks providing top-up credit/financing facilities to meet down payments on mortgage loans and/or property-backed consumer loans/financing. Furthermore, prudential principles are also regulated in terms of providing property credit/financing facilities if the property to be used as collateral is not fully available, namely that it is only permitted on the first loan.

The regulatory amendment is contained within Bank Indonesia Circular No. 15/40/DKMP, dated 24th September 2013, concerning the Application of Risk Management at Banks that provide Property Credit or Financing, Property-Backed Consumer Loans or Financing, as well as Automotive Loans and Financing. The new regulation supersedes the previous regulations, namely Circular No. 14/10/DPNP, dated 15th March 2012 and Circular No.14/33/DPbS, dated 27th November 2012. In addition, the new regulation will be effective as of 30th September 2013 for conventional banks, Islamic banks and sharia business units equally.

The new LTV/FTV regulation will be subject to further adjustments in harmony with prevailing economic conditions as well as overall banking industry performance.

Jakarta, 25 September 2013

Communication Department

Difi A. Johansyah

Executive Director