Bank Indonesia’s Monetary Policy Tight until Current Account Balance Improves

The central bank of Indonesia (Bank Indonesia) indicated that it will only loosen its monetary policy provided that the country’s current account deficit narrows to a level of 2.5 percent of gross domestic product (GDP), which is considered sustainable, and inflation is kept within the range of 3.5 to 5.5 percent (year-on-year) in line with the central bank’s target range. The current account deficit is one of the main problems being faced by Southeast Asia’s largest economy today and causes concern among foreign and domestic investors.

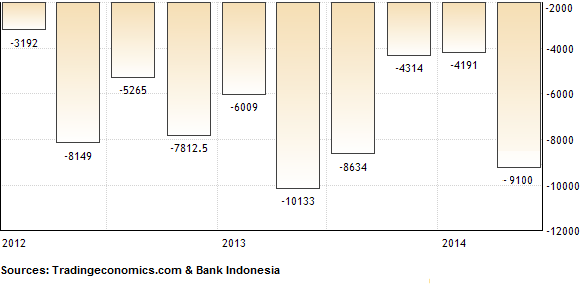

Recently, Bank Indonesia announced that the current account deficit widened to USD $9.1 billion, or, 4.27 percent of the country's GDP in the second quarter of 2014. This widening was much larger than forecasted by analysts and also meant a sharp widening from (a revised) 2.05 percent of GDP deficit recorded in the previous quarter. Since late-2011, Indonesia has had to cope with a structural current account deficit.

Current Account Balance Indonesia (in million USD)

Governor of Bank Indonesia Agus Martowardojo said that although the central bank sees an improvement of the current account balance in 2014 (compared to the deficit of 3.3 percent of GDP in full-year 2013), the current account deficit is still too high at more than 3 percent in 2014. The institution targets a sustainable level of 2.5 percent of GDP. He added that the main cause of the deficit is the generous fuel subsidy policy of the Indonesian government. The current government has done few to fix this problem. Indonesia’s recently released Revised State Budget of 2015 (RAPBN 2015) allocates IDR 363.5 trillion (about USD $31.2 billion) to energy subsidies, of which IDR 291.1 trillion is for fuel. These fuel subsidies also burden the state budget (limit public investments in more structural and long-term matters such as infrastructure) and cause public concern about Indonesia’s fiscal sustainability.

Martowardojo stressed that the fuel subsidy issue needs to be addressed to safeguard future capital inflows, particularly ahead of higher US interest rates. The fuel subsidy policy will be one of the most important matters to tackle for the new Joko Widodo-led government that will be inaugurated in October 2014. Government fuel subsidies have risen sharply in the past decade as can be seen in the table below.

Indonesian Energy Subsidies:

| Year | Fuel Subsidies |

Electricity Subsidies |

| 2015 | 291.1 | 72.4 |

| 2014 | 246.5 | 103.8 |

| 2013 | 210.0 | 99.9 |

| 2012 | 211.9 | 94.6 |

| 2011 | 165.2 | 90.4 |

| 2010 | 82.4 | 57.6 |

| 2009 | 45.0 | 49.5 |

| 2008 | 139.1 | 83.9 |

| 2007 | 83.8 | 33.1 |

| 2006 | 64.2 | 30.4 |

| 2005 | 95.6 | 8.9 |

| 2004 | 69.0 | 2.3 |

in trillion rupiah

Bank Indonesia started its monetary tightening in mid-2013 when speculation emerged that the US Federal Reserve’s quantitative easing program (which caused a large flow of cheap US dollars to emerging markets' assets) would end soon resulting in massive capital outflows from Indonesia. Bank Indonesia then gradually raised its benchmark interest rate (BI rate) from 5.75 percent to 7.50 percent between June and November 2013. Besides the risks that were brought about by the looming end of US quantitative easing, this measure was also taken to combat higher inflation after the government raised prices of subsidized fuels in June 2013, and reduce pressures on the current account balance (as well as to curb rupiah depreciation) which had reached a record high level at USD $10.1 billion or 4.5 percent of GDP in the second quarter of 2013.