Forecast of Indonesian July Inflation and August Benchmark Interest Rate

The pace of Indonesian inflation in July 2014 is expected to be in the range of 0.60 to 0.75 percent (month-on-month). If realized, this would be one of the lowest July inflation figures in recent Indonesian history. Traditionally, the month of July brings high inflationary pressures as consumers spend more on food products and other consumer goods as well as transportation amid the holy fasting month of Ramadan and subsequent Idul Fitri celebrations (which also involves the mudik tradition).

This solid performance is attributed to prudent government management as it anticipated on possible shortages of certain food products during Ramadan and Idul Fitri, thus reducing volatility of food prices. The government ordered imports of rice, sugar, chili and beef. The gold price has also stayed relatively stable, which had a positive effect on the Indonesian rupiah exchange rate.

On a year-on-year basis, inflation is projected to ease to below 5 percent (year-on-year) in July 2014, a significant decline from 6.70 percent (yoy) in the previous month. Last year, July inflation had accelerated sharply (3.29 percent month-on-month) after the government had decided to raise prices of subsidized fuels In June 2013.

Previously, both Finance Minister Chatib Basri and Deputy Governor at Indonesia’s central bank (Bank Indonesia), Mirza Adityaswara, had already stated that they see July inflation below the level of one percent (month-on-month). The central bank still expects year-end inflation to be within its target range of between 3.5 and 5.5 percent. However, it will most likely be in the upper range of that target.

On Monday (04/08), Statistics Indonesia (BPS) will release the official July 2014 inflation figure.

Inflation in Indonesia:

| Month | Monthly Growth 2013 |

Monthly Growth 2014 |

| January | 1.03% | 1.07% |

| February | 0.75% | 0.26% |

| March | 0.63% | 0.08% |

| April | -0.10% | -0.02% |

| May | -0.03% | 0.16% |

| June | 1.03% | 0.43% |

| July | 3.29% | |

| August | 1.12% | |

| September | -0.35% | |

| October | 0.09% | |

| November | 0.12% | |

| December | 0.55% | |

| Total | 8.38% | 1.99% |

| Inflation Rate June 2014 |

Inflation Rate Calender 2014 |

Inflation Rate year-on-year |

|

| General | 0.43 | 1.99 | 6.70 |

| - Core | 0.25 | 1.88 | 4.81 |

| - Administered Price | 0.45 | 2.37 | 13.47 |

| - Volatile | 1.06 | 2.22 | 6.74 |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Inflation (annual percent change) |

9.8 | 4.8 | 5.1 | 5.4 | 4.3 | 8.4 |

Source: Statistics Indonesia

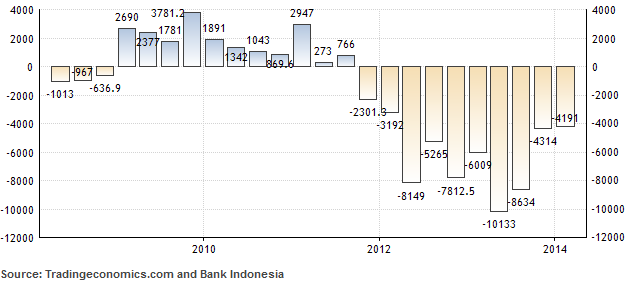

With inflation under control, the central bank is expected to maintain its benchmark interest rate (BI rate) at 7.50 percent at the next Board of Governor’s Meeting (scheduled for Thursday 14 August). This policy would be in line with the central bank’s aim to reduce the country’s current account deficit to a more sustainable level. In the first quarter of 2014, the current account deficit was recorded at USD $4.2 billion, equivalent to 2.03 percent of the country’s gross domestic product (GDP). This deficit is particularly caused by a wide deficit in oil trade. Another reason why Bank Indonesia will most likely not lower the BI rate is because of the risk of capital outflows amid looming interest rates hikes in the USA early next year.

Current Account Balance of Indonesia (in USD million):